In addition, the attribution and related party rules apply to these disclosures.įor example, if a family of 5 persons each owns 20% of the partnership LLC, no one person owns at least 50% of the company. If the partnership has an owner that owns greater than 50% of the LLC, then the identity of that partner must be disclosed explicitly on a Schedule B-1 and attached to the tax return. The Schedule B questionnaire asks the following questions:ĭid any individual, estate, foreign corporation, domestic corporation, partnership, trust, or tax-exempt organization, own directly or indirectly 50% or more in the partnership’s profit, loss, or capital?

The second disclosure occurs on Schedule B-1 of Form 1065. It is common for large real estate investment partnerships, hedge funds, and private equity funds to have thousands of partners in a single LLC.

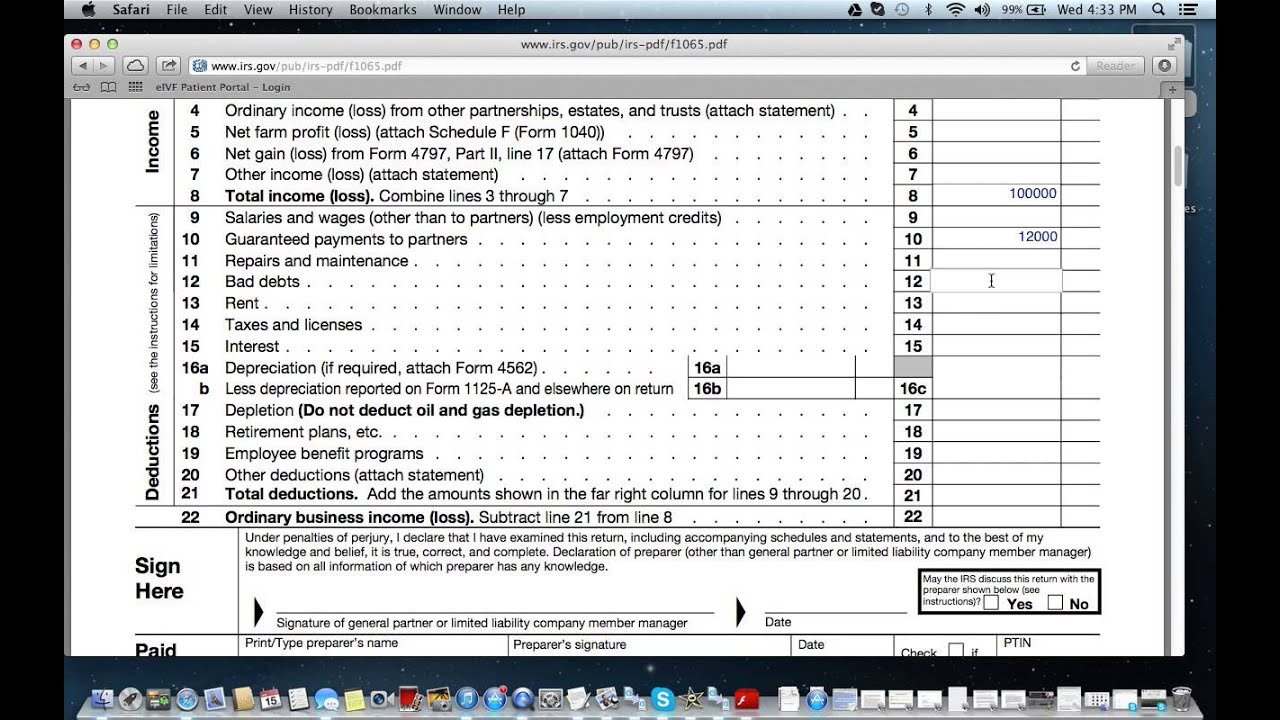

Every partner should receive a Schedule K-1 that lists their name, tax ID number, address, percentage ownership interest, capital account reconciliation, and allocation of income, expense, and other partnership tax items.Įven in cases where a partnership has thousands of individual partners, each partner should receive a Schedule K-1. The first disclosure occurs on Schedule K-1 for each owner. Generally, the partnership will disclose the identity of the owners to the IRS on two areas of Form 1065. The net amounts are ultimately allocated to the partnership owners and reported on a Schedule K-1 for each owner. Partnership entities are pass-through entities for federal tax purposes, which means that the partnership reports its total income and expenses on Form 1065. partnership needs to file an annual Form 1065 partnership tax return.

0 kommentar(er)

0 kommentar(er)